Amur Capital Management Corporation - Questions

The 7-Minute Rule for Amur Capital Management Corporation

Table of ContentsThings about Amur Capital Management CorporationThe 10-Second Trick For Amur Capital Management Corporation8 Simple Techniques For Amur Capital Management CorporationThe Of Amur Capital Management CorporationThe Of Amur Capital Management CorporationIndicators on Amur Capital Management Corporation You Need To Know

Foreign direct investment (FDI) occurs when an individual or organization owns at least 10% of a foreign company. When financiers own less than 10%, the International Monetary Fund (IMF) defines it simply as component of a stock profile. Whereas a 10% possession in a company does not offer a specific capitalist a managing passion in a foreign company, it does permit influence over the company's administration, procedures, and general policies.Business in establishing countries require multinational funding and know-how to broaden, give framework, and lead their worldwide sales. These foreign companies require personal financial investments in facilities, energy, and water in order to increase work and incomes (mortgage investment). There are different degrees of FDI which vary based on the kind of business involved and the factors for the financial investments

Unknown Facts About Amur Capital Management Corporation

Other forms of FDI include the purchase of shares in a linked business, the consolidation of a wholly-owned firm, and engagement in an equity joint venture across worldwide boundaries (https://www.avitop.com/cs/members/amurcapitalmc.aspx). Capitalists that are preparing to engage in any kind of FDI could be smart to consider the financial investment's advantages and negative aspects

FDI boosts the manufacturing and solutions sector which leads to the development of jobs and assists to minimize joblessness rates in the nation. Boosted work translates to higher earnings and gears up the populace with even more purchasing power, enhancing the overall economy of a country. Human funding included the expertise and competence of a workforce.

The creation of 100% export oriented units assist to assist FDI investors in increasing exports from various other countries. The flow of FDI into a country translates into a continual flow of foreign exchange, helping a nation's Central Bank preserve a thriving reserve of forex which causes steady currency exchange rate.

Fascination About Amur Capital Management Corporation

As a result of FDI, nations' neighborhood firms begin losing passion to spend in their domestic items. Other nations' political activities can be transformed constantly which could hamper the capitalists. Foreign direct investments can often affect exchange rates to the benefit of one country and the detriment of an additional (https://www.gaiaonline.com/profiles/amurcapitalmc/46642563/). When financiers buy international counties, they could observe that it is a lot more expensive than when items are exported.

Taking into consideration that international straight investments might be capital-intensive from the point of view of the capitalist, it can in some cases be really risky or economically non-viable. Continuous political changes can lead to expropriation. In this instance, those countries' federal governments will certainly have control over investors' residential or commercial property and assets. Several third-world countries, or at the very least those with background of manifest destiny, fret that international straight investment would certainly result in some kind of modern-day financial manifest destiny, which reveals host nations and leave them at risk to foreign business' exploitation.

Avoiding the achievement gap, improving health end results, increasing revenues and giving a high price of economic returnthis one-page file summarizes the benefits of buying top quality very early youth education for disadvantaged kids. This file is commonly shown policymakers, supporters and the media to make the instance for very early childhood years education and learning.

Amur Capital Management Corporation - An Overview

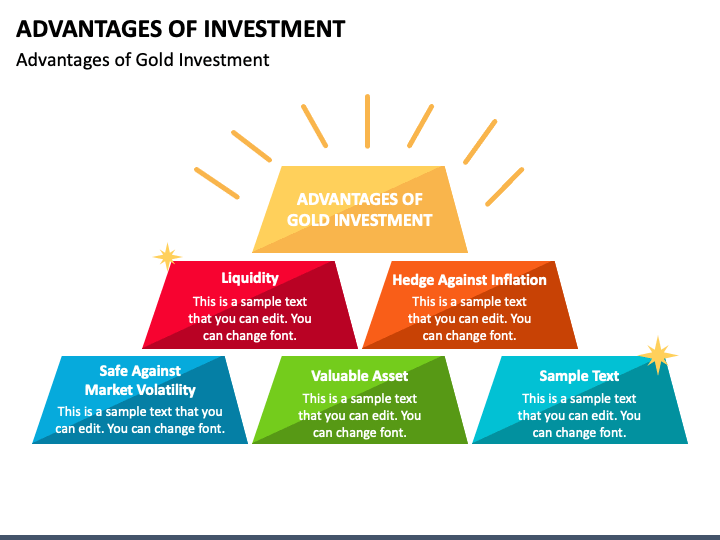

Think about exactly how gold will fit your monetary objectives and long-lasting financial investment plan before you spend - best investments in copyright. Getty Images click here for more info Gold is often taken into consideration a strong property for and as a in times of uncertainty. The valuable steel can be appealing through periods of financial uncertainty and economic downturn, along with when inflation runs high

Amur Capital Management Corporation Fundamentals Explained

"The ideal time to construct and assign a design profile would certainly be in much less unpredictable and demanding times when feelings aren't regulating decision-making," says Gary Watts, vice head of state and monetary consultant at Wealth Improvement Team. Besides, "Sailors outfit and arrangement their watercrafts before the tornado."One method to determine if gold is ideal for you is by researching its advantages and drawbacks as an investment choice.

If you have money, you're successfully losing money. Gold, on the various other hand, may. Not everyone agrees and gold may not always climb when inflation rises, yet it can still be an investment factor.: Buying gold can possibly help investors survive unsure economic conditions, considering the during these periods.

Not known Details About Amur Capital Management Corporation

That does not suggest gold will certainly always go up when the economy looks shaky, yet maybe great for those that intend ahead.: Some financiers as a way to. Instead of having every one of your money locked up in one property class, various could potentially aid you better manage threat and return.

If these are a few of the advantages you're trying to find after that start investing in gold today. While gold can aid include balance and security for some financiers, like the majority of financial investments, there are also risks to keep an eye out for. Gold might outpace other possessions throughout particular periods, while not standing up as well to long-term cost gratitude.